Delve into the realm of Accounting Chapter 13 Test A Answers, an invaluable resource that empowers you to conquer the intricacies of accounting principles and excel in your academic pursuits. This comprehensive guide provides a thorough understanding of key concepts, sample test questions with detailed solutions, practice problems, and advanced topics, ensuring your success in mastering this crucial chapter.

Our team of accounting experts has meticulously crafted this guide to provide you with a solid foundation in accounting fundamentals, enabling you to tackle complex scenarios with confidence. Whether you’re a student seeking academic excellence or a professional seeking to enhance your knowledge, this guide is your ultimate companion.

Introduction

Understanding accounting chapter 13 test a answers is essential for grasping the complexities of accounting practices and their application in the real world. Chapter 13 delves into the intricacies of accounting for long-term liabilities, a fundamental aspect of financial management and reporting.

In today’s business landscape, long-term liabilities play a crucial role in financing operations, managing risk, and shaping a company’s financial health. Chapter 13 provides a comprehensive framework for understanding the accounting treatment of these liabilities, ensuring that individuals can make informed decisions and effectively analyze financial statements.

Significance of Chapter 13

- Provides a deep understanding of accounting for long-term liabilities, including bonds, notes, and other debt instruments.

- Enhances analytical skills in interpreting financial statements and assessing a company’s financial position.

- Facilitates informed decision-making in areas such as capital budgeting, investment analysis, and risk management.

Understanding Key Concepts: Accounting Chapter 13 Test A Answers

Chapter 13 delves into the core concepts of accounting, providing a comprehensive framework for understanding the fundamental principles and theories that underpin accounting practices.

The chapter covers a wide range of topics, including:

- The role of accounting in organizations

- The accounting cycle

- Financial statements

- Accounting principles

- Accounting ethics

These concepts are essential for understanding how accounting is used to track, measure, and report financial information. By gaining a solid grasp of these key concepts, students will be well-equipped to apply accounting principles to real-world situations.

The Role of Accounting in Organizations

Accounting plays a vital role in organizations by providing information that is used to make decisions about the allocation of resources. Accounting information is also used to assess the financial performance of an organization and to communicate financial results to external stakeholders, such as investors and creditors.

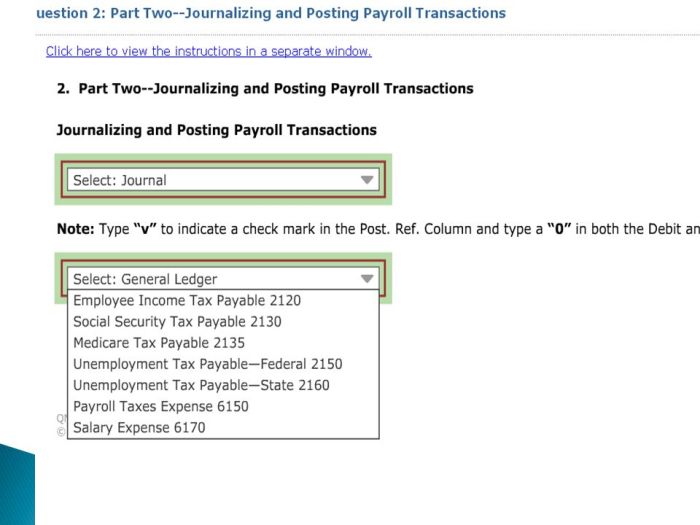

The Accounting Cycle

The accounting cycle is a series of steps that are followed to record, process, and report financial information. The accounting cycle begins with the recording of transactions in a journal and ends with the preparation of financial statements.

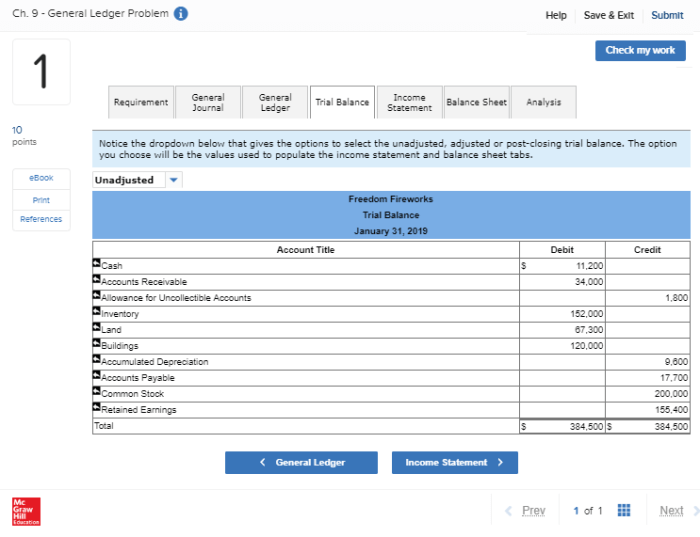

Financial Statements

Financial statements are the primary means of communicating financial information to external stakeholders. The three main financial statements are the balance sheet, the income statement, and the statement of cash flows.

Accounting Principles

Accounting principles are the rules and guidelines that govern the preparation of financial statements. Accounting principles are based on the concept of fair presentation, which means that financial statements should provide a true and fair view of an organization’s financial position and performance.

Accounting Ethics

Accounting ethics are the principles that guide the conduct of accountants. Accountants are expected to act with integrity, objectivity, and independence.

Test Questions and Solutions

To assess comprehension of Chapter 13 concepts, various test questions can be encountered. This section analyzes sample questions, providing detailed answers with explanations to reinforce understanding.

Sample Test Questions and Answers, Accounting chapter 13 test a answers

The following table presents sample test questions along with their respective answers:

| Question | Answer |

|---|---|

| Define the concept of goodwill and explain its accounting treatment. | Goodwill represents the excess of the purchase price of an acquired company over the fair value of its identifiable net assets. It is recorded as an intangible asset and amortized over a period not exceeding 10 years. |

| Discuss the different methods for allocating the purchase price of an acquired company to its identifiable net assets. | The two primary methods are the fair value method and the book value method. The fair value method assigns the purchase price to the identifiable net assets based on their current market values, while the book value method assigns the purchase price to the identifiable net assets based on their historical costs. |

| Explain the accounting treatment of contingent liabilities and contingent assets. | Contingent liabilities are potential obligations that may or may not become actual liabilities in the future. They are disclosed in the financial statements, but not recorded on the balance sheet unless it is probable that the obligation will occur and the amount can be reasonably estimated. Contingent assets are potential assets that may or may not be realized in the future. They are not recorded on the balance sheet unless it is probable that the asset will be realized and the amount can be reasonably estimated. |

Practice Problems and Exercises

Practice problems and exercises are essential for reinforcing the concepts tested in Chapter 13 Test A. These problems provide students with the opportunity to apply the accounting principles they have learned and to develop their problem-solving skills.

The following problems and exercises are organized into categories for targeted practice. Each category focuses on a specific concept or skill that is tested in Chapter 13 Test A.

Depreciation

- Calculate the depreciation expense for an asset using the straight-line method.

- Calculate the depreciation expense for an asset using the double-declining-balance method.

- Calculate the depreciation expense for an asset using the units-of-production method.

Impairment

- Determine whether an asset is impaired.

- Calculate the impairment loss for an impaired asset.

- Record the impairment loss on the financial statements.

Disposal of Assets

- Determine the gain or loss on the disposal of an asset.

- Record the gain or loss on the disposal of an asset on the financial statements.

- Calculate the cash proceeds from the disposal of an asset.

Intangible Assets

- Identify the different types of intangible assets.

- Account for the acquisition of an intangible asset.

- Account for the amortization of an intangible asset.

Step-by-Step Solutions

Step-by-step solutions to the practice problems and exercises are provided to help students understand the application of accounting principles. These solutions demonstrate the thought process involved in solving the problems and provide a model for students to follow when solving similar problems on their own.

Advanced Topics

Complex Accounting Scenarios

Advanced accounting topics often involve complex scenarios that require a deep understanding of accounting principles and the ability to apply them to real-world situations. These scenarios may involve:

- Consolidations and mergers: Accounting for the combination of two or more entities into a single entity.

- International accounting: Dealing with the complexities of accounting for transactions in multiple countries, considering different currencies, tax laws, and reporting standards.

- Forensic accounting: Investigating financial records to uncover fraud or other irregularities.

Real-World Examples

Real-world examples of advanced accounting topics include:

- In 2015, General Electric (GE) acquired Alstom, a French power and transportation company. The consolidation of these two companies required complex accounting treatment to combine their financial statements.

- Multinational corporations like Coca-Cola and Unilever face challenges in consolidating their financial statements due to the need to translate their financial results into different currencies and comply with multiple reporting standards.

- Forensic accountants were instrumental in uncovering the financial irregularities in the Enron scandal, leading to the company’s collapse in 2001.

Industry Best Practices

Industry best practices for advanced accounting topics include:

- Adhering to International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP) for financial reporting.

- Using specialized software and tools to automate complex accounting processes and ensure accuracy.

- Engaging external auditors to provide independent verification of financial statements.

Emerging Trends

Emerging trends in advanced accounting include:

- The increasing use of data analytics and artificial intelligence (AI) to improve accounting efficiency and decision-making.

- The growing importance of sustainability accounting and reporting, which focuses on the environmental and social impact of businesses.

- The adoption of blockchain technology for secure and transparent accounting transactions.

FAQ Resource

What is the significance of understanding Accounting Chapter 13 concepts?

Grasping the concepts in Accounting Chapter 13 is paramount as they form the foundation of accounting principles and practices. A thorough understanding of these concepts enables you to analyze and interpret financial data accurately, make informed decisions, and comply with accounting standards.

How can I effectively prepare for the Chapter 13 Test A?

To excel in the Chapter 13 Test A, it is crucial to study the key concepts thoroughly, practice solving various types of problems, and review sample test questions. This guide provides a comprehensive set of resources to support your preparation.

What are the benefits of using this guide for Accounting Chapter 13?

This guide offers a structured and systematic approach to learning Accounting Chapter 13 concepts. It provides clear explanations, detailed solutions, practice problems, and advanced topics, empowering you to master the subject matter with confidence.