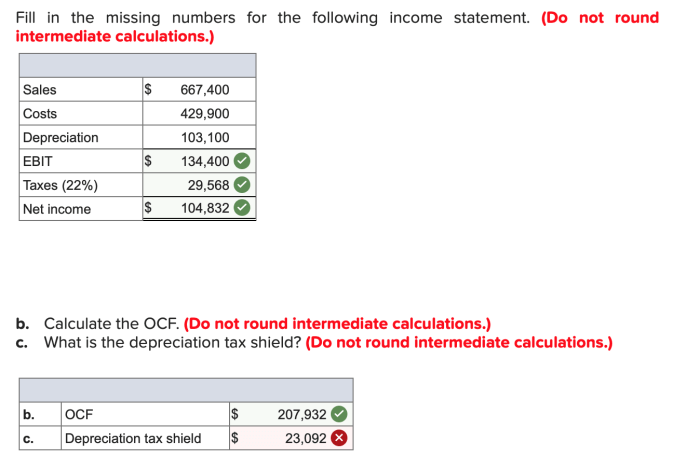

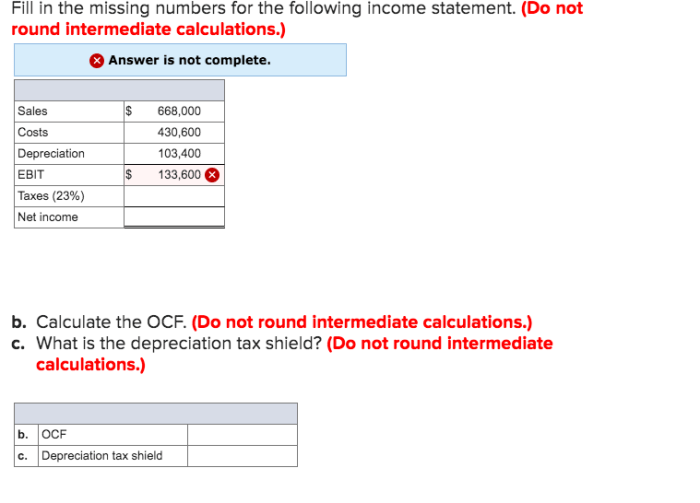

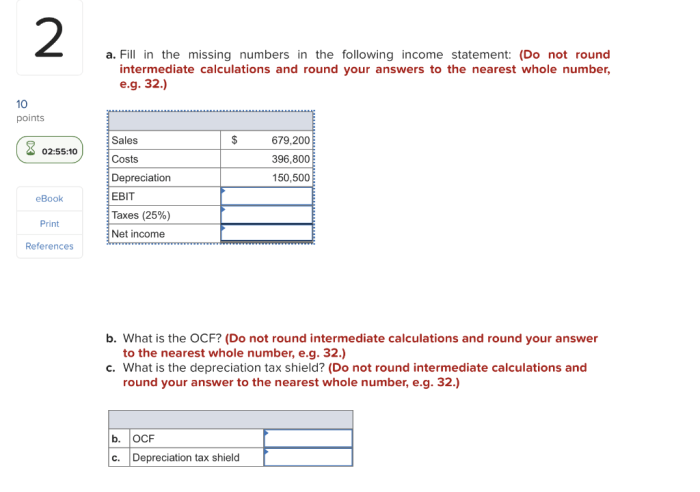

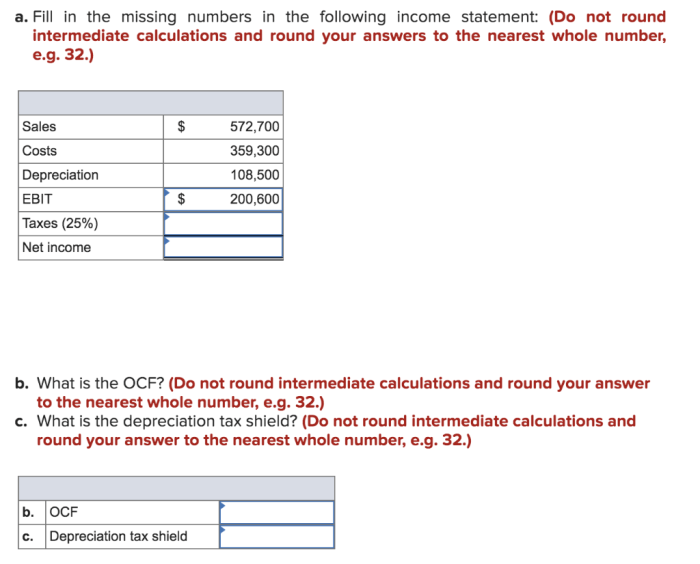

Fill in the missing numbers for the following income statement – In the realm of financial analysis, the income statement stands as a crucial document, providing a comprehensive overview of a company’s financial performance. This article embarks on a journey to decipher the intricacies of the income statement, guiding you through the process of filling in the missing numbers and gaining a profound understanding of its significance.

The income statement serves as a roadmap, navigating through various financial metrics, including revenue, cost of goods sold, gross profit, operating expenses, and net income. By delving into each component, we uncover the underlying factors that drive a company’s financial health and profitability.

Income Statement: A Comprehensive Guide

An income statement is a financial document that summarizes a company’s revenues, expenses, and profits over a specific period. It is one of the three main financial statements, along with the balance sheet and the cash flow statement.

Revenue

Revenue is the total amount of money earned by a company from its sales of goods or services.

| Product | Quantity | Unit Price | Total Revenue |

|---|---|---|---|

| Product A | 100 | $10 | $1,000 |

| Product B | 50 | $20 | $1,000 |

| Product C | 25 | $30 | $750 |

| Total | 175 | $2,750 |

Cost of Goods Sold: Fill In The Missing Numbers For The Following Income Statement

Cost of goods sold (COGS) is the cost of the goods that a company has sold during a specific period. COGS includes the direct costs of producing the goods, such as raw materials, labor, and overhead.

- Raw materialsare the materials used to produce the goods.

- Laboris the cost of the workers who produce the goods.

- Overheadis the cost of the other expenses incurred in producing the goods, such as rent, utilities, and depreciation.

Gross Profit

Gross profit is the difference between revenue and COGS. Gross profit represents the amount of money that a company has left after paying for the costs of producing its goods.

Gross profit margin is a measure of a company’s profitability. It is calculated by dividing gross profit by revenue.

Industry benchmarks for gross profit margins vary depending on the industry. For example, the gross profit margin for the manufacturing industry is typically around 20%, while the gross profit margin for the retail industry is typically around 30%.

Operating Expenses

Operating expenses are the costs incurred by a company in the day-to-day operations of its business. Operating expenses include expenses such as salaries, rent, utilities, and marketing.

| Expense Category | Amount | Percentage of Revenue | Comparison to Previous Period |

|---|---|---|---|

| Salaries | $1,000 | 10% | 5% increase |

| Rent | $500 | 5% | No change |

| Utilities | $250 | 2.5% | 2% decrease |

| Marketing | $250 | 2.5% | 10% increase |

| Total | $2,000 | 20% |

Net Income

Net income is the profit that a company has left after paying all of its expenses, including COGS and operating expenses. Net income is also known as the bottom line.

Net income margin is a measure of a company’s profitability. It is calculated by dividing net income by revenue.

Factors that can affect net income include:

- Revenue

- COGS

- Operating expenses

- Taxes

Quick FAQs

What is the significance of the income statement?

The income statement provides a comprehensive snapshot of a company’s financial performance, enabling stakeholders to assess its revenue-generating capabilities, cost structure, profitability, and overall financial health.

How can I fill in the missing numbers on an income statement?

To fill in the missing numbers, you can utilize financial data from the company’s financial statements, such as the balance sheet and cash flow statement. Additionally, industry benchmarks and ratios can provide valuable guidance.

What are some common mistakes to avoid when analyzing an income statement?

Common pitfalls include relying solely on net income as a measure of financial performance, overlooking non-operating income and expenses, and failing to consider the impact of seasonality or one-time events on financial results.