Reading a paycheck stub worksheet is a crucial skill for managing personal finances. This guide delves into the intricacies of paycheck stubs, empowering individuals to decipher their income, deductions, and net pay effectively.

By understanding the various sections and information presented on a paycheck stub, individuals can gain valuable insights into their financial situation and make informed decisions about budgeting, saving, and financial planning.

Understanding Paycheck Stubs

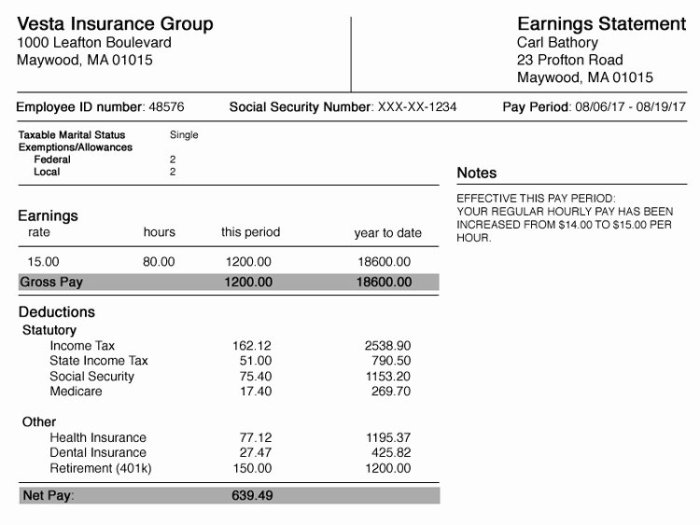

Paycheck stubs are essential documents that provide a detailed breakdown of an employee’s earnings and deductions for a specific pay period. Understanding these stubs is crucial for managing personal finances, budgeting, and tax planning.

Common sections found on a paycheck stub include:

- Gross pay: Total earnings before deductions

- Net pay: Amount received after deductions

- Deductions: Items subtracted from gross pay, such as taxes, insurance, and retirement contributions

- Tax withholdings: Amounts withheld for income taxes, social security, and Medicare

- Year-to-date earnings and deductions: Accumulated amounts since the beginning of the year

Analyzing Income and Deductions

Income sources listed on a paycheck stub may include:

- Wages or salary

- Overtime pay

- Bonuses

- Commissions

Common deductions include:

- Federal income tax

- Social security tax

- Medicare tax

- State income tax (if applicable)

- Health insurance premiums

- Retirement contributions

| Income | Deductions |

|---|---|

| Wages | Federal income tax |

| Overtime | Social security tax |

| Bonus | Medicare tax |

| Commission | Health insurance premiums |

Calculating Net Pay

Net pay is calculated by subtracting total deductions from gross pay. The formula is:

Net pay = Gross pay

Total deductions

Gross pay includes all earnings, while total deductions include all items subtracted from gross pay, such as taxes and insurance premiums.

For example, if an employee has a gross pay of $1,000 and total deductions of $200, their net pay would be $800.

Understanding Tax Withholdings

Tax withholdings are amounts withheld from an employee’s paycheck to cover estimated income taxes. These withholdings are based on the employee’s income, filing status, and allowances claimed on their W-4 form.

Common types of taxes withheld include:

- Federal income tax

- Social security tax

- Medicare tax

- State income tax (if applicable)

Tax withholding calculations are complex and vary depending on individual circumstances. However, employees can use the IRS withholding calculator to estimate their tax liability and adjust their withholdings as needed.

Reading Paycheck Stubs for Financial Planning: Reading A Paycheck Stub Worksheet

Paycheck stubs provide valuable information for budgeting and financial planning. By understanding the income and deductions listed on the stub, individuals can:

- Create realistic budgets based on net pay

- Identify areas for potential savings

- Make informed decisions about financial goals, such as saving for retirement or paying off debt

By reviewing paycheck stubs regularly, individuals can gain a better understanding of their financial situation and make informed decisions to improve their financial well-being.

FAQ Guide

What is the purpose of a paycheck stub?

A paycheck stub provides a detailed record of an employee’s earnings, deductions, and net pay for a specific pay period.

What are some common sections found on a paycheck stub?

Common sections include gross pay, deductions (e.g., taxes, insurance premiums), net pay, and year-to-date earnings and deductions.

How is net pay calculated?

Net pay is calculated by subtracting total deductions from gross pay.